– Vineer Bhansali

Diversification is the most important topic in investing. (Illustrations such as The Farmer’s Fable are really helpful.) It’s also the topic to which most investors pay lip service without actually doing much about it.

At a very basic level, I tend to think that all investments can be categorized as offensive or defensive.

Offensive assets tend to be correlated with GDP growth and do well in “good times” – stocks, bonds, real estate, venture capital and private equity would all go in this bucket for me.

Defensive assets tend to be anti-correlated with GDP and do well in “bad times.” Some historical examples of popular defensive assets would be Gold, US Treasuries (post-2000 at least), put options and trend following strategies.

My opinion is that investors want to have roughly equal portions in both offensive and defensive assets if their goal is to achieve the best long-term risk-adjusted returns.

Since most investors tend to be heavily invested in offensive assets, the question is generally about which defensive strateg(ies) are most appropriate.

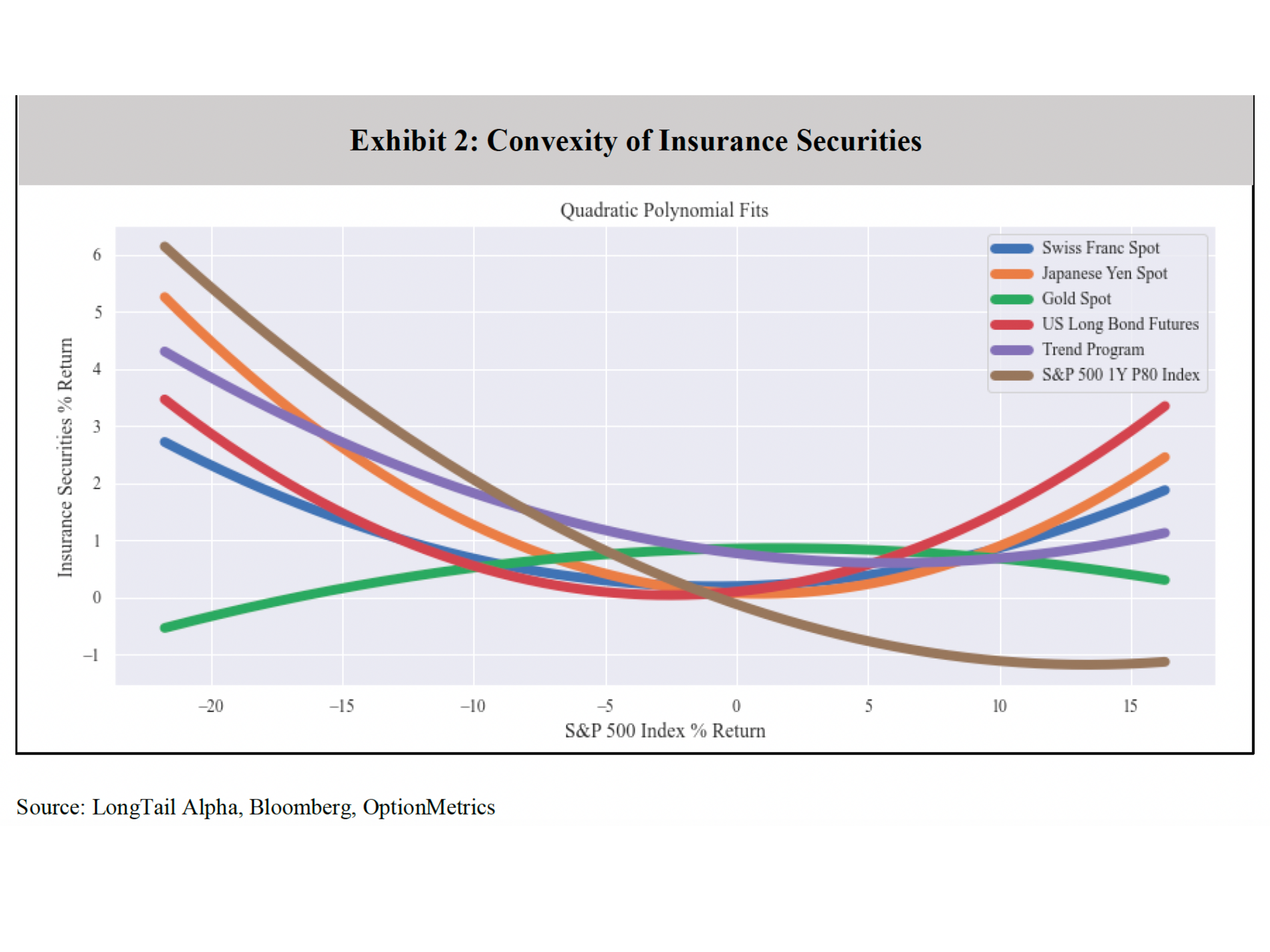

This paper from Vineer Bhansali and Jeremie Holdom used fifty years of data to look at six popular diversifying securities: Gold, Swiss Francs, Japanese Yen, Bond Futures, S&P 500 80% strike Put Options, and Trend Following strategies.

Which one or combination was best?

The first thing they found was that these different assets tended to have different “convexity characteristics.” Some were more like super-charged defensive assets that performed better and better as markets fell, but also tended to perform worse as markets were rising.

Others were the opposite and could do well as markets were rising but didn’t offer the same protection when markets were falling.

Said another way, each of these assets covered different path dependencies that can happen in a risk-off sell-off or market crash.

You could think of them as different types of insurance policies. For example, you might have car insurance that covers your liability up to $500,000 and costs you $1,000/year. Then you might have umbrella insurance that covers you up to $2,000,000 and costs you $200/year.

The umbrella policy has a lot more convexity in the sense that you are getting up to $2mm in coverage at a lower premium, however you’re going to use it only in extreme circumstances. The basic car insurance covers one, more common path dependency and the umbrella insurance covers another less common, but more risky one.

In much the same way, different defensive assets can do well in different situations and so using a combination of them ends up being more effective than trying to pick the “best” one.

What’s the right mix?

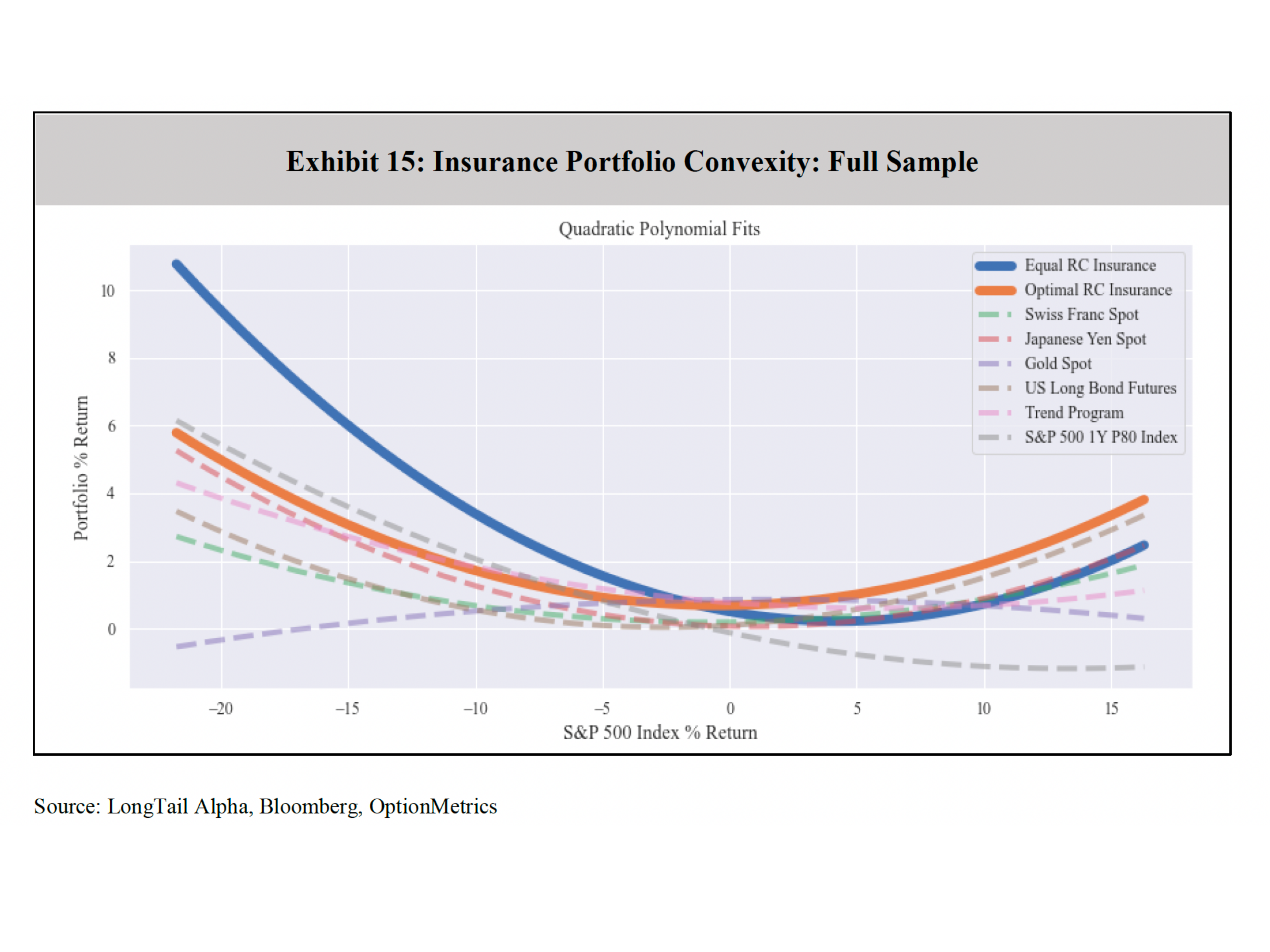

Ultimately, the paper found that a simple equal-weight approach to all six assets (Gold, Swiss Francs, Japanese Yen, Bond Futures, S&P 500 80% strike Put Options, and Trend Following strategies) performed the best out of sample.

Even though optimization of the insurance security basket might marginally improve the performance in cherry-picked scenarios, a simple approach of equally risk weighting insurance securities in a portfolio does just as well on average, and increases the reliability of diversification in mitigation of downside risk.

The added benefit of using this simple “Occam’s Razor” approach is that it eliminates the need for perfect foresight of correlations, volatilities, and prospective performance. We believe that together these results show that when diversying portfolios, the best approach is to diversify the diversifiers.

Investors are thus best positioned to manage downside risks when they use every tool in the toolkit, rather than selecting just one or two that might be the fashion of the day.

This research suggests that most investors would benefit from diversifying their diversifiers (defensive assets) and probably use a more “naive” approach closer to equal weight than some more complex mean-variance optimization.

This finding supports our methodology with the Cockroach Strategy which uses three different long volatility strategies and an ensemble of trend following strategies that trade dozens of commodity markets at different time horizons. These are used in roughly equal weights as opposed to a more risk-parity approach where they are optimized based on historical metrics.

Ultimately, we believe that this equally weighted ensemble of defensive strategies combined with offensive strategies such as stocks and bonds is best prepared for an unknown and unknowable future.