– HENRY NEVILLE, TEUN DRAAISMA, BEN FUNNELL, CAMPBELL R. HARVEY, and OTTO VAN HEMERT1

As talk of inflation is all the rage these days, it’s worth asking: what assets perform in an inflationary regime?

That was the subject of this paper which looked at passive and active strategies across a variety of asset classes for the U.S., U.K., and Japan over the past 95 years.

The TL;DR:

Unexpected inflation is bad news for traditional assets, such as bonds and equities, with local inflation having the greatest effect. Commodities and futures trend following performance is strong during inflationary periods, with US regimes particularly relevant, and the most pronounced effect when the US, UK and Japan experience inflation simultaneously.

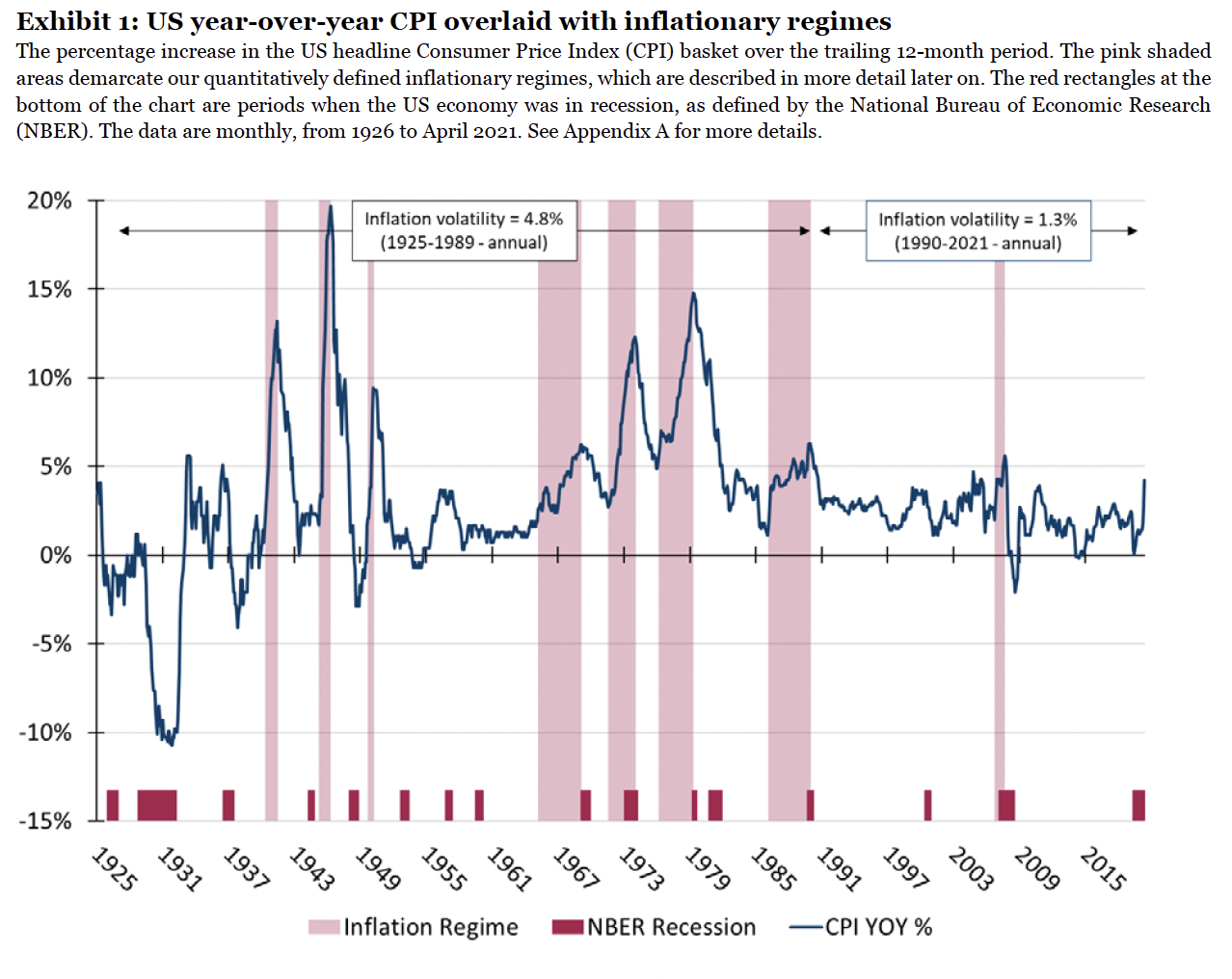

First, it’s important to remember that the last ~35 years or so in the U.S. hasn’t really seen a meaningful inflationary regime (with the exception of a blip post 2008/GFC). The preceding ~25 years from 1985 going back to the 1960s were pretty persistently inflationary.

As a result, few investors today have lived through an inflationary regime and so many investors are unprepared for a period of persistent inflation.

So what does the data from this paper say about which assets do well in inflationary periods?

Bonds

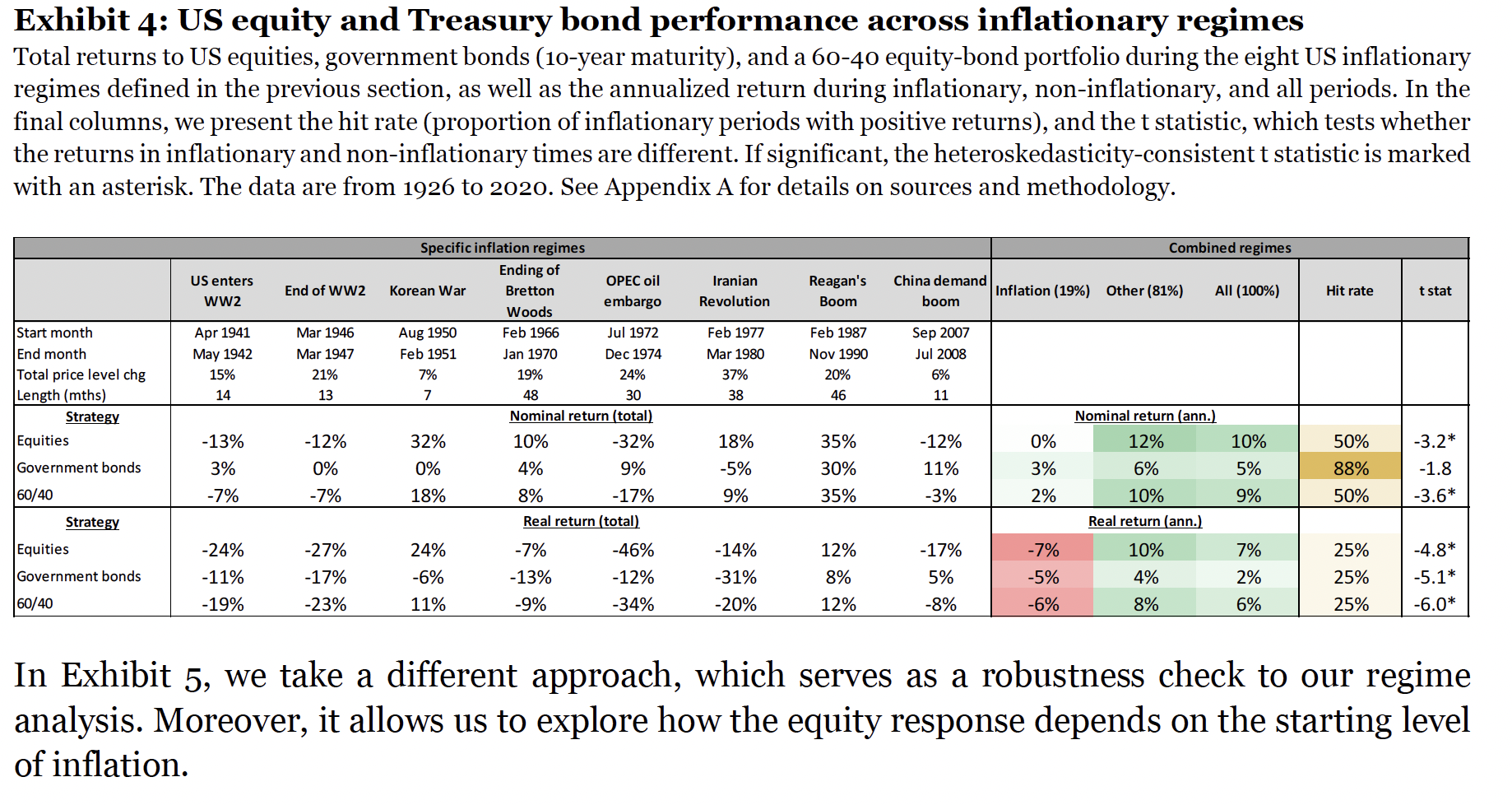

To start, weak returns are observed for bonds. During the inflationary periods, 30 year US treasury bonds returned -8% annualized (see chart below).

This is not surprising. Rising inflation is typically associated with rising yields, and thus declining bond prices.

Historically, when inflation occurs, central banks such as the Federal Reserve raise interest rates to try and slow down inflation. As interest rates rise, say from 2% to 4%, then you only need half as many bonds to get the same yield.

(E.g. If you own a $100 face value bond paying 2% annually then you get $2 of yield per year. However, if the market expects interest rates go from 2% to 4%, you only need $50 in nominal bond value to get the same $2 in yield. As a result, the value of the bond tends to go down.)

Equities

Perhaps more notable is that equities also perform poorly. I would say this is the biggest misconception in investors I talk to worrying about inflation.

The standard response I heard is usually something to the effect of “companies will raise prices when inflation sets in and so equities will remain strong.”

There is a certain logic to this: equities may be expected to deliver some inflation protection, as a firm’s debt obligations are inflated away and product prices may be adjusted to inflation.

However, this paper shows that over the last century, equities tend to do poorly in inflationary regimes with U.S. equities returning -7% annualized over the 8 inflationary regimes analyzed here (albeit with better performance from some equity factors such as cross-sectional momentum). Equities had negative real returns in 75% of the regimes.

What could explain equities poor performance in inflationary periods?

Historically, it would seem that the less stable economic climate and costs tend to rise with inflation more than output prices. The authors explain:

First, higher and more volatile inflation creates more economic uncertainty, thus harming the ability of companies to plan, invest, grow, and engage in longer-term contracts. Moreover, while firms with market power can increase their output prices to mitigate the impact of an inflation surprise, many companies can only partially pass on the increased cost of raw materials. Margins therefore shrink.

Second, unexpected inflation may be associated with future economic weakness. While an overheating may cause companies’ revenues to increase in the short-term, if the inflation is followed by economic weakness, this will decrease expected future cash flows.

Third, there is a tax implication for companies with high capital expenditures. Given that depreciation is calculated based on the asset’s historic cost (unadjusted for change in CPI), in an environment of high and rising inflation, the recognized expense will be artificially low.

In particular, inflationary regimes have been challenging for smaller companies compared to larger companies. In real terms, the premium for being long small size and short large size is -4% a year in inflationary periods, compared to +1% in normal times.

This makes some intuitive sense:

The costs of inflation will have some economies of scale benefit to them. Take “shoe-leather costs,” for instance (Fischer and Modigliani 1978), meaning the extra effort that companies have to make when the value of cash is more volatile—making more trips to the bank and wearing out their shoes being the analogy.

Larger companies are more suited to reacting to these conditions, given that they are more likely to have the necessary infrastructure to make such adaptations seamlessly.

60/40

Given the poor performance of both equities and bonds, Inflationary regimes have posed a major challenge to a traditional 60% stock/40% bond portfolio. The average annualized real returns of a 60/40 portfolio in the inflationary periods studied here was -6%.

Real Estate

Another commonly touted inflation hedge is real estate such as owning your own house. However, this is also not well supported by the historical data.

US residential real estate has a small negative annualized real return of -2% during inflationary regimes.

If you have fixed interest rate mortgage on your home, this may be somewhat or fully offset as the debt is getting inflated away but it doesn’t seem to be the slam dunk it’s often presented as.

Commodities

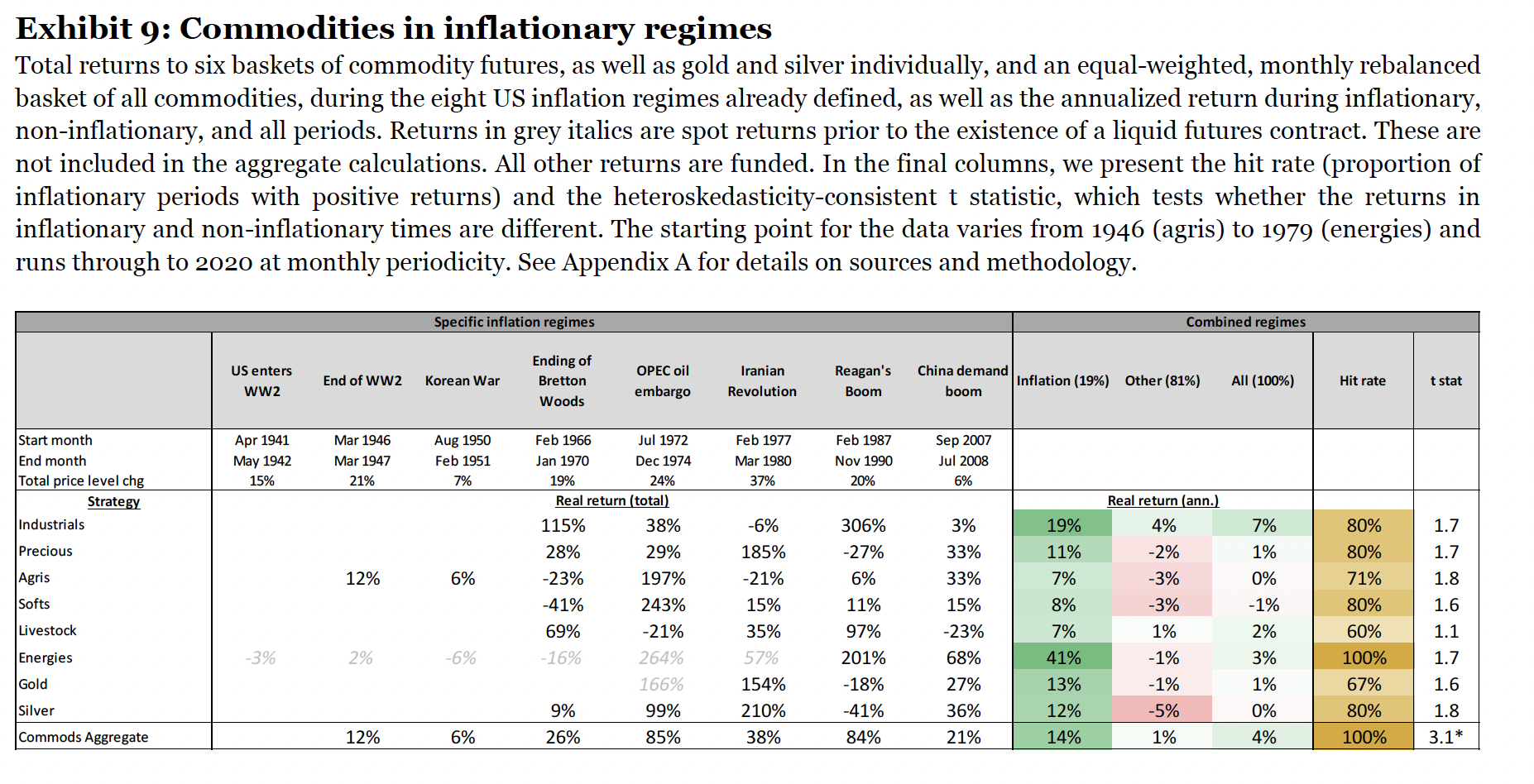

The clear winner in inflationary regimes is commodities in aggregate. A basket of commodities has generated positive real returns during the eight US regimes studied, averaging an annualized +14% real return.

In normal/non-inflationary periods where U.S. equities return 10% annualized, commodities in aggregate returned about 1%.

That means commodities have not only been robust to rising inflation but have benefited from them compared to “normal” times.

In my opinion, this is why commodity exposure makes sense as part of a broader portfolio. Implemented appropriately, they have historically been flat most of the time, but have helped ballast a portfolio with equities and bond exposure in an inflationary period.

Why a basket of commodities as opposed to just a single commodity like gold or other precious metals?

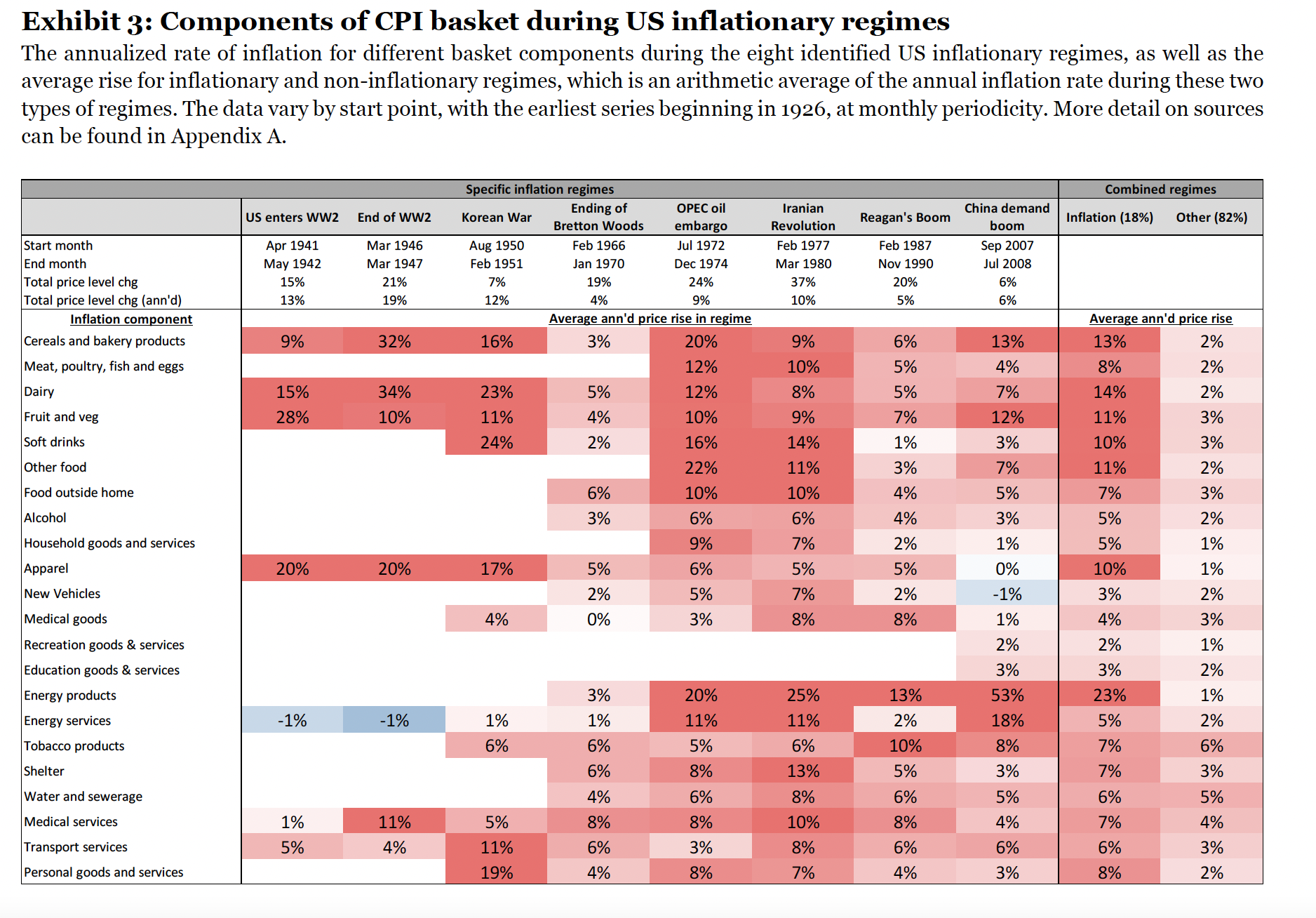

The authors look into whether each inflationary regime is driven by only a few items that pull the overall inflation rate up. The data looked at 125 different components and 79 of them, or 63%, experienced annualized inflation of 5% or more in the inflationary regimes.

That is to say, inflation showed up broadly across different sectors, not just in some isolated areas. This suggests a basket of commodities should be more robust to inflation and fare better than a single commodity such as gold.

Gold

Though gold is a favorite asset for those looking to hedge inflation, it’s notable that gold has underperformed industrials and energies historically.

The end of Bretton Woods in the early 1970s and end to the gold peg led to a huge bull market in gold during the 70s and into the early 1980s. It’s hard to say how reliable gold is as inflation hedge going forward as no similar dynamic exists today.

Trend Following

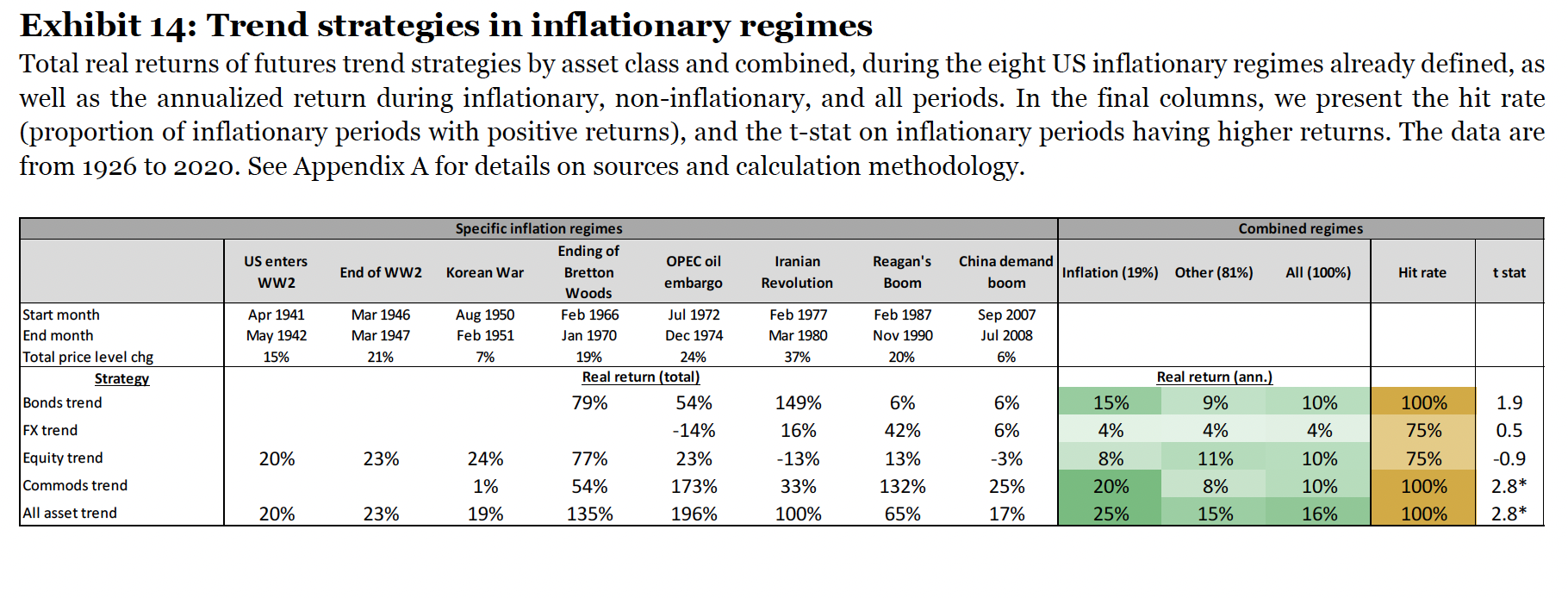

Of the active strategies studied, the all asset trend strategy performed the best.

Trend is an approach that is (sort of) the opposite of value investing: it tends to buy things that have gone up already and sell things that have gone down already, betting that the trend will persist.

Historically during inflationary periods, it seems that trend strategies have benefitted from being long commodities as commodity prices rose.

Commodity focused trend strategies also seem superior to buy and hold commodities as they have captured much of the upside while also being able to profit from declining commodity prices when the trends reverse.

While the trend-following strategies perform better than the equity factors, they are less discussed because they have limited capacity and so many investors do not have access to trend strategies.

However, for investors able to get access, it may provide an effective way to hedge against inflationary pressures.